Berkshire Hathaway Changes Its Stock Portfolio

Warren Buffett’s Company Makes New Moves

Berkshire Hathaway, led by Warren Buffett, recently updated its stock holdings. The company revealed new investments and changes in its major holdings.

Bought Shares in UnitedHealth

Berkshire Hathaway bought a new stake in UnitedHealth Group, a major U.S. health insurance company.

This is the first time Berkshire invested in UnitedHealth.

The move shows growing interest in healthcare companies.

UnitedHealth provides health insurance and other health-related services.

It is one of the largest healthcare companies in the U.S.

Berkshire believes the company has strong future potential.

Reduced Stake in Apple

At the same time, Berkshire cut its stake in Apple Inc.

Apple has been Berkshire’s biggest stock holding for years.

But now, the company is slowly reducing that position.

This is not the first time Berkshire sold some Apple shares.

In recent quarters, Berkshire has trimmed its Apple holdings.

Even with the sale, Apple remains the largest stock in Berkshire’s portfolio.

Apple Still Holds Value

Buffett has called Apple one of Berkshire’s best investments.

He praised Apple’s brand, loyal customers, and strong profits.

Even after the cut, Berkshire owns a big part of Apple.

Berkshire may be taking profits or adjusting its portfolio.

The company often buys and sells based on long-term goals.

Portfolio Adjustments Are Normal

Buffett and his team often change the company’s stock holdings.

They look for strong businesses with long-term value.

They also sell shares when prices rise or better options appear.

These changes help Berkshire grow and manage risk.

Buying UnitedHealth and selling Apple may be part of this strategy.

Other Portfolio Changes

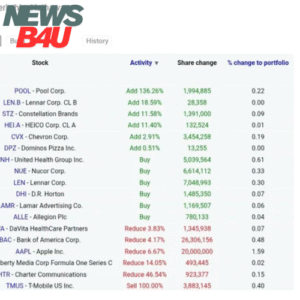

Along with UnitedHealth and Apple, Berkshire made other small moves:

Berkshire’s portfolio includes dozens of companies across industries.

These include tech, energy, finance, and consumer products.

Focus on Value Investing

Warren Buffett is known for value investing.

He looks for companies that are undervalued but have strong futures.

His team does deep research before buying any stock.

Buying UnitedHealth shows interest in long-term healthcare trends.

Cutting Apple shares may help free up cash for new ideas.

Apple’s Stock Has Performed Well

Apple stock has gone up a lot in recent years.

Berkshire bought Apple when the price was lower.

Selling some now gives Berkshire strong profits.

Still, Apple is not going away from the portfolio.

Berkshire still owns hundreds of millions of shares.

UnitedHealth Looks Promising

UnitedHealth has grown steadily over the years.

It offers insurance plans, pharmacy services, and health tech.

It has a strong reputation and large customer base.

Healthcare demand is rising as the population ages.

This makes companies like UnitedHealth attractive to investors.

Berkshire’s Portfolio Reflects the Economy

By looking at Berkshire’s stocks, we see what industries it trusts.

Healthcare and technology remain key sectors.

Berkshire also keeps some cash for future opportunities.

The company has a long-term view.

It does not follow short-term trends or hype.

Buffett’s Team Makes the Decisions

Buffett is the face of Berkshire, but he has help.

Todd Combs and Ted Weschler help manage the stock portfolio.

They may have led the move into UnitedHealth.

Buffett still oversees the big picture.

He trusts his team and gives them freedom to invest.

Berkshire’s Portfolio Reflects the Economy

By looking at Berkshire’s stocks, we see what industries it trusts.

Healthcare and technology remain key sectors.

Berkshire also keeps some cash for future opportunities.

The company has a long-term view.

It does not follow short-term trends or hype.

Buffett’s Team Makes the Decisions

Buffett is the face of Berkshire, but he has help.

Todd Combs and Ted Weschler help manage the stock portfolio.

They may have led the move into UnitedHealth.

Buffett still oversees the big picture.

He trusts his team and gives them freedom to invest.

What It Means for Investors

Berkshire’s moves often catch attention.

Many people watch Buffett to learn how to invest.

If Berkshire buys a stock, others often follow.

Buying UnitedHealth may boost interest in healthcare stocks.

Selling Apple may not signal a problem, just a shift in strategy.

Berkshire Remains Strong

Berkshire Hathaway owns many businesses.

These include GEICO, BNSF Railway, Dairy Queen, and more.

It also holds billions in stocks like Apple and Coca-Cola.

The company has over $100 billion in cash.

This gives it power to invest when it sees chances.

Looking Ahead

Berkshire’s stock changes reflect careful planning.

The team wants to grow value over time.

They focus on strong businesses, not short-term gains.

Apple remains a top holding.

UnitedHealth is a new bet on the future of healthcare.

Berkshire may continue to adjust its portfolio in coming months.