![]() “Bank of England cuts interest rates, but says it’s not sure about more cuts in the future.”

“Bank of England cuts interest rates, but says it’s not sure about more cuts in the future.”

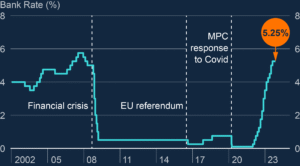

The Bank of England has lowered interest rates to 4%.

This means borrowing money may now be a bit cheaper.

The Bank’s decision-makers, called the Monetary Policy Committee, cut the rate by 0.25%.

It’s the lowest the rate has been since March 2023.

They said there’s still some uncertainty about whether rates will be cut again in the future.

One reason for the cut is that wages are not rising as fast as before.

They also said there is now less worry about the effects of US tariffs.

The decision is likely to bring relief to some borrowers, who will benefit from lower mortgage deals entering the market as a result of the Bank’s base rate being lowered.

Bank of England Governor Andrew Bailey said the decision to cut rates was a “close call.”

The committee couldn’t agree at first, so they had to vote a second time.

Bailey explained that it’s still unclear what will happen with rates in the future.

He said the group is divided, and the economic data is sending mixed signals.

“I do think rates will keep going down,” Bailey said.

“But there’s real uncertainty about how that will happen.”

He added that there are risks that could push inflation either higher or lower.

Inflation is expected to accelerate in the coming months, putting more pressure on household budgets.

Consumer price index (CPI) inflation is now on track to peak at 4% in September, surpassing previous guidance that it would peak at 3.5%.